2023 Property Value Reappraisal

FOR IMMEDIATE RELEASE

2023 PROPERTY VALUE REAPPRAISAL

CHARDON, OH –

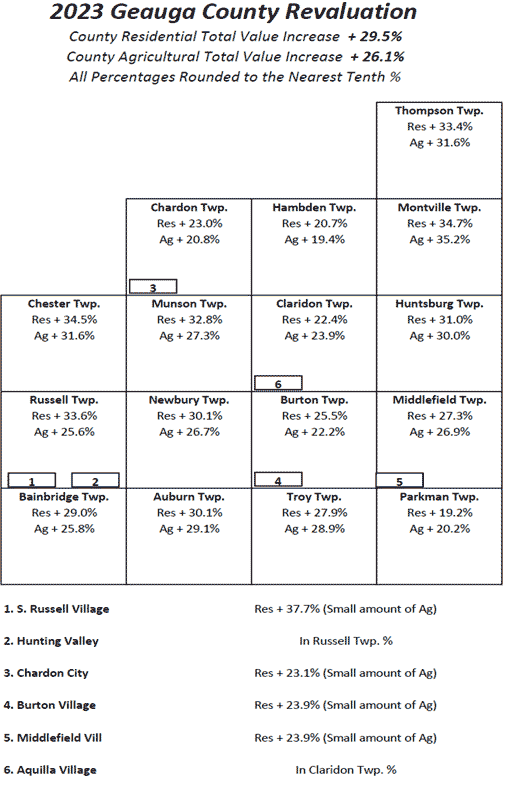

Geauga County Auditor Charles E. Walder has been notified by the Ohio Department of Taxation that they are ordering Geauga County real estate residential values to increase an average of 29.5%, as of January 1, 2023, based on sales in the county over the past three years. As a result, many homeowners will see large value increases this year.

“As seen throughout the United States, these past three years have been an aggressive and competitive real estate market in Geauga County,” said Auditor Walder. “We have seen sustained sales numbers with increased sales prices and reduced inventory, creating a seller’s market and driving property values up.”

Auditor Walder reminds homeowners that all property taxes do not increase by the same percentage as values. Due to Ohio law, previously voted tax levy rates are “reduced” to their value when passed, even when property values increase. Non-voted levies, however — or inside millage — is not reduced and changes proportionately with valuation, which directly affects these property taxes.

Geauga County is undergoing the State-mandated Sexennial Reappraisal process this year. The state-mandated reappraisal, which is done every 6 years, is an in-depth parcel-by-parcel field review of property and sales that occurred during 2020, 2021, and 2022, conducted by certified and licensed property appraisers. The State of Ohio has required Geauga County to review the last 3 years of sales and to trend the county’s property values to reflect market value changes. The new values will be used in calculating your 2023 taxes, payable in 2024.

Auditor Walder is making his staff and appraisers available to property owners to discuss these new values. In the coming weeks, property owners will be mailed a letter with new valuations and information about how to discuss valuations with the Auditor’s Office’s staff.

“I encourage the public to participate in this process,” Auditor Walder said. “This is an unprecedented time, and we are here to help residents as best we can within the legal confines dictated to us by Columbus.”

For more information, please see the Auditor’s website at https://auditor.geauga.oh.gov/appraisal/reappraisal, or call (440) 279-1601.